Are the election betting odds a good indicator?

And if they aren't being manipulated then why the volatility?

Markets aren’t always efficient mechanisms for forecasting.

Markets can be manipulated. Ask anyone who trades securities at a hedge fund—they’d tell you just the same. At a market-wide level, influential money managers like Bill Ackman can substantially sway investors and move markets by, for instance, appearing on CNBC and sounding the alarm.1

Even at the individual stock-level, one could make the argument that the Gamestop saga in 2021 was a collective manipulation by a crusade of retail investors. The list of examples goes on (and isn’t limited to the stock market). Though financial market regulations have come a long way in thwarting manipulation, people are creative and will always find new ways to game the system.

Fundamentally, price discovery in any market occurs at the intersection of supply—or holders willing to sell—and demand—or buyers willing to buy—for an underlying asset. The U.S. presidential election betting odds markets are no exception.

If you haven’t kept up with the election betting markets, something curious has transpired over the past couple weeks: there’s been a significant divergence between the election betting markets and the polls.

What do the polls say?

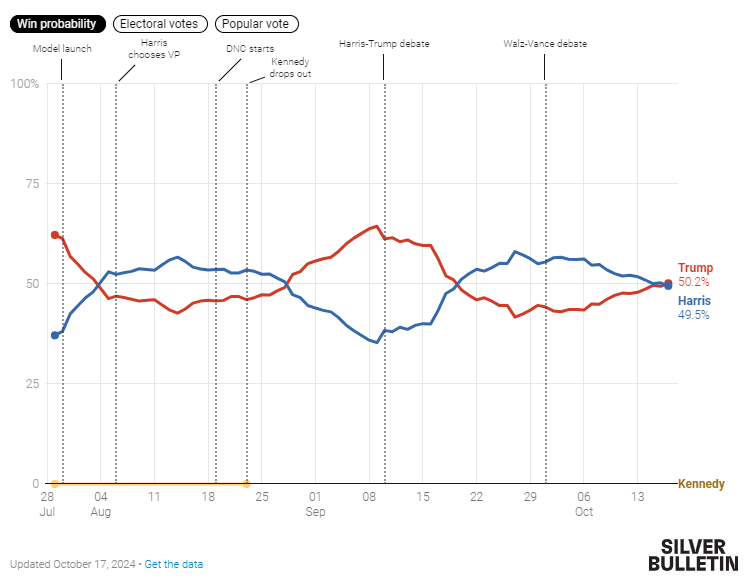

With just 18 days until the election, the pollsters are largely depicting the race as a toss-up. My go-to for election polling data is

of Silver Bulletin (formerly of FiveThirtyEight), an expert in probabilistic modeling and, as far as I can tell, unbiased in his analysis.2 Recently, Nate’s forecast showed the race at a near-exact 50/50 split—a toss up.Nate’s latest post on the matter shows Trump having taken the lead for the first time since September 19th: Trump 50.2%, Harris 49.5%. (There’s an 0.3% chance of a 269-269 tie). And while these odds may vary from one poll to the next, most polls generally show a tight race at the moment.

What do the betting markets say?

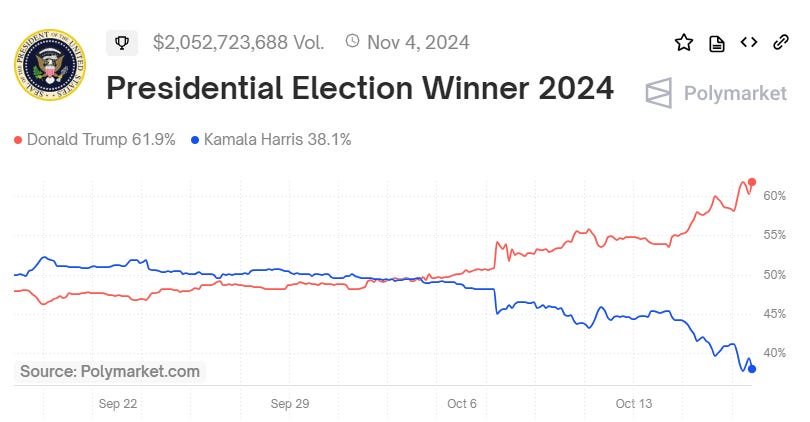

Since late July, when Kamala Harris was selected as the Democrats’ candidate, the Polymarket3 odds have (more or less) fluctuated in tandem with the odds derived from polling data.

And while the same general correlation has persisted between betting markets and pollster odds, there’s been an interesting divergence over the past ten days. It began the morning of October 7, when Trump’s odds suddenly spiked based on no apparent event or new information.

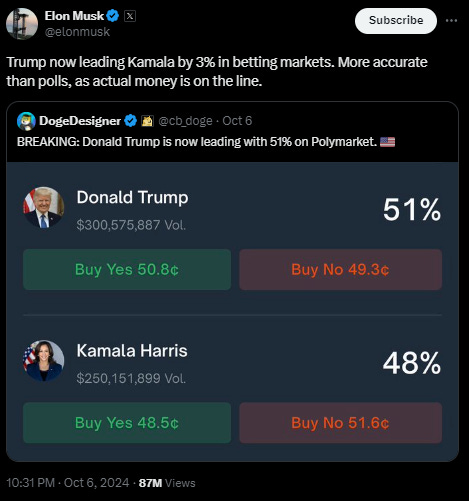

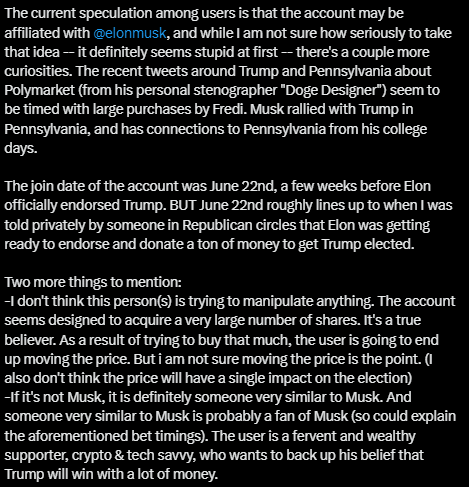

As it turns out, the spike did correspond (almost to the hour) with Elon Musk’s post on X, sharing that Trump had taken a lead in the betting markets.

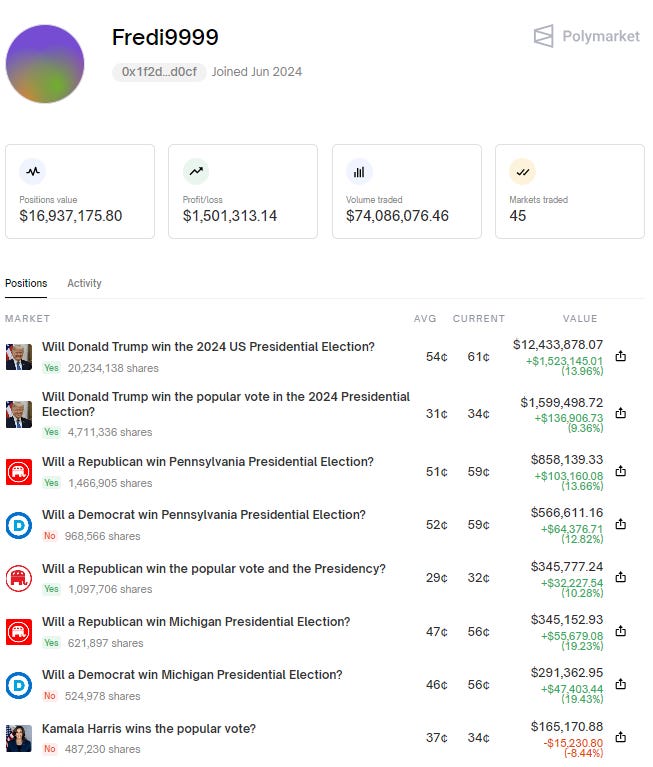

(among others) shed light on this oddity in his October 9 post, noting that the price increase was driven in large part by the activity of a single trader, “Fredi9999”, who had, by then, accumulated pro-Trump positions totaling about $8.4 million. Rajiv pointed out several other interesting dynamics:This trader (or consortium) is adopting a very particular strategy—placing large limit buy orders slightly above the current best bid, effectively setting a floor on the price of the Trump contract.

The price is high enough that it doesn’t get outbid, so for long stretches (especially overnight in the US) anyone wanting to bet against Trump ends up trading with this account.

You can see that Fredi9999 is the counterparty for virtually all traders betting against Trump, especially overnight, by looking at the activity associated with the account.

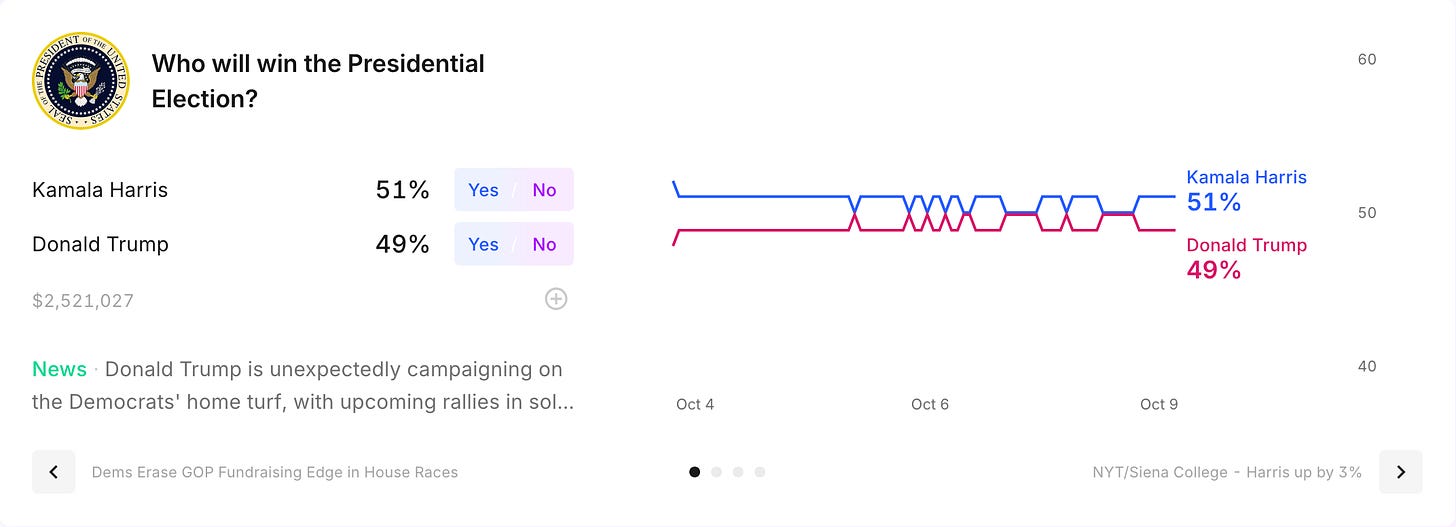

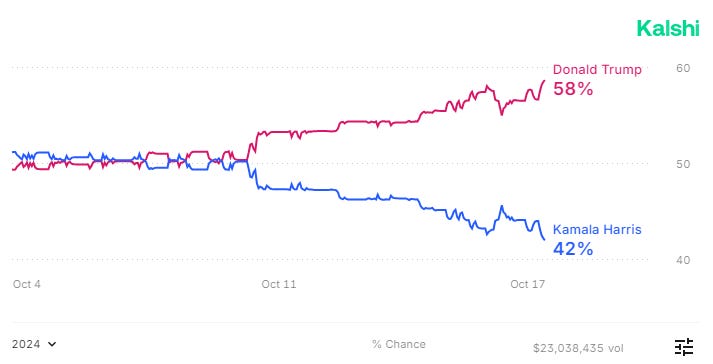

However, as of October 9, the price moves on Polymarket were not yet being reflected in other betting markets such as Kalshi, a newly-legal and strictly-regulated exchange, with restrictions on participation to only US nationals (and good luck in trying to use a VPN).4

Fast forward to October 17, and the odds on Kalshi have, too, diverged from the pollster odds—though not quite to the extent Polymarket odds have.

Furthermore, the value of Fredi999’s positions have nearly doubled over the past week or so as the account continues purchasing pro-Trump contracts (along with just about every other pro-Republican bet available).

So who the hell is Fredi999 anyway? Nobody knows yet, but one thing’s for certain: the person (or consortium of people) behind the account is deeply pocketed. Many believe the entity behind the account is being run by a Frenchman. According to the X account of a full-time political bettor (named Domer, and take this with the prescribed grain of salt, obviously), Fredi9999 was briefly reached and indeed claims to be a fervent believer in the prospects of a Republican victory in November.

What does it all mean for the US elections?

It’s long been the consensus opinion of experts in event-driven markets that betting odds are an efficient forecasting mechanism since the odds are set as a result of price discovery via real money wagers on one side or the other. This assumes that all market participants have an interest in profiting, and will exploit divergences in the market’s current price from a collectively rational forecast. But it’s more complicated in this case, for one or more of several possible reasons:

It’s worth noting that the Fredi9999 account could be hedging against some sort of event (business-related or otherwise)5 hinging on the election’s outcome. The ‘elephant in the room’ of the Polymarket-place, Fredi9999’s continuous bidding (recall previous

comments) is providing a floor for the price of ‘Trump wins’ contracts (among other pro-Republican contracts).Given that Polymarket bets are exclusively waged in crypto, the platform’s demographics may be skewed in favor of a collective crowd of participants who are predisposed to bullishness on Trump. Think ‘crypto bros’—how would you peg them as a voting bloc? Not to be presumptuous, but I’d say they’re more MAGA than Momala. (That is a limb I’m willing to go out on.)

Even though the betting odds divergence from polling odds originated on Polymarket, the Kalshi odds having since converged with Polymarket. This could’ve happened as the result of arbitrage traders—that is, traders who seek to exploit profit opportunities when some asset (stock, commodity, election outcome contract, etc.) is trading at two different prices in two different marketplaces. In such an event, neither Polymarket’s nor Kalshi’s current odds would be the result of efficient or pure price discovery.

As to whether Fredi9999 has manipulative motives, history does provide some precedent to the oddities we’re currently seeing in political betting markets. His (her, its?) strategy is virtually identical to a case in 2012 when a trader known as the “Romney Whale” who was betting on Mitt Romney to win had accumulated roughly $7 million in bets, and was a party to almost 23,000 separate trades. The Romney Whale obviously lost it all (Obama won the election), and evidence suggests that the trader was indeed attempting to manipulate voter perception.

As to the question of whether the divergence of betting odds versus polling odds helps or hurts either party’s chances come election day, there’s no clear answer. It’s important to remember that voter turnout is paramount to actually, well, turning out votes.

To that end, ask yourself: if you believed that the candidate you’re inclined to vote for is already leading by a large enough margin, would you feel compelled to actually go out and vote? Or would you say “To hell with it, he/she already has it in the bag,” capitulate, and stay home on election day?

has a fantastic piece on this question, and what it could ultimately mean for this election’s outcome. In any event, my attention has been gained, and I’d be lying if I told you I have conviction one way or the other.In this case (March 2020), to his own benefit, as his firm was holding a sizable position of credit default swaps

Nate’s model is the direct descendant of the f/k/a FiveThirtyEight election forecast and the methodology is largely the same, other than removing COVID-19 provisions introduced for 2020. Other changes from 2020 are documented here. And an archive of the Biden-Trump forecast can be found here.

The Silver Bulletin polling averages are a little fancy. They adjust for whether polls are conducted among registered or likely voters and house effects. They weight more reliable polls more heavily. And they use national polls to make inferences about state polls and vice versa. It requires a few extra CPU cycles — but the reward is a more stable average that doesn’t get psyched out by outliers.

Polymarket only takes bets via cryptocurrency

For instance, the exchange prohibits trading by anyone holding federal or statewide office, staffers or contractors for presidential campaigns, employees of political party organizations and polling outfits, those working at decision desks for major media companies, and all congressional staff.

Laura Beers, a professor of history and expert on political betting at American University, told Newsweek there are numerous reasons an anonymous trader would be betting so much money on a Trump victory.

"If Fredi9999 has business interests that stand to lose from a Trump victory, they could be betting on one to offset those potential future loses," she said. "There is evidence that British bettors used election markets this way in the early 20th century."

However, she noted that the trader "has been involved in significant in-and-out trading," suggesting "that they might be seeking to profit from market manipulation of their own devising, or just to profit from taking advantage of what they see as temporary shifts in the market."

Yeah. He’s been pretty open about it. But here is a link. https://www.axios.com/2024/07/16/nate-silver-polymarket

The betting markets more reliable. Unlike the media, the bookies have a financial stake in prediction not to lie to the public.