U.S. election odds update: Prediction markets remain diverged from election models

The Trump Trend continues - but is he actually pulling away in the race, or are the prediction markets distorted?

Election odds update: Trump is still trending

In light of the emerging gulf between election betting markets and polling models, I wrote a piece last week explaining why I believe prediction market (betting) odds aren’t necessarily indicative of a ‘best guess’ as to who will win the election. Specifically, I noted that while real-money wagers are often efficient forecasting mechanisms, several complicating factors challenge this assumption.

Let’s start with recent updates on this developing story, which has sparked significant attention.

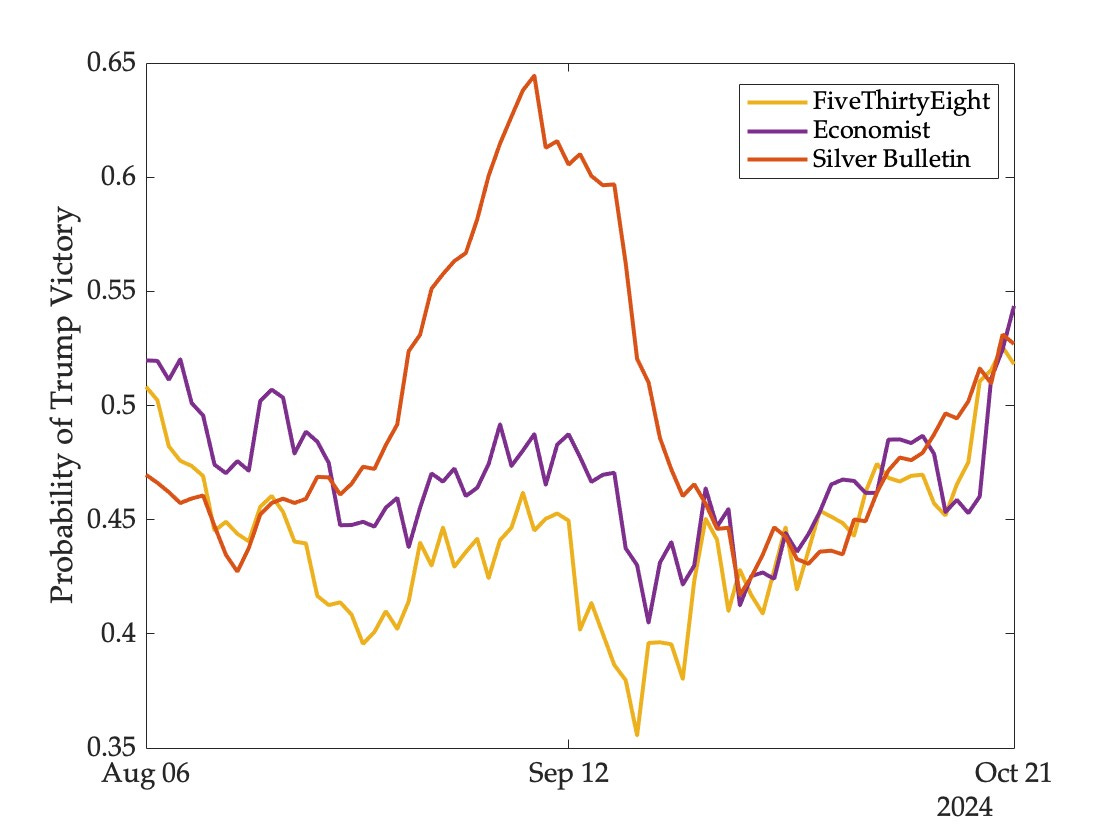

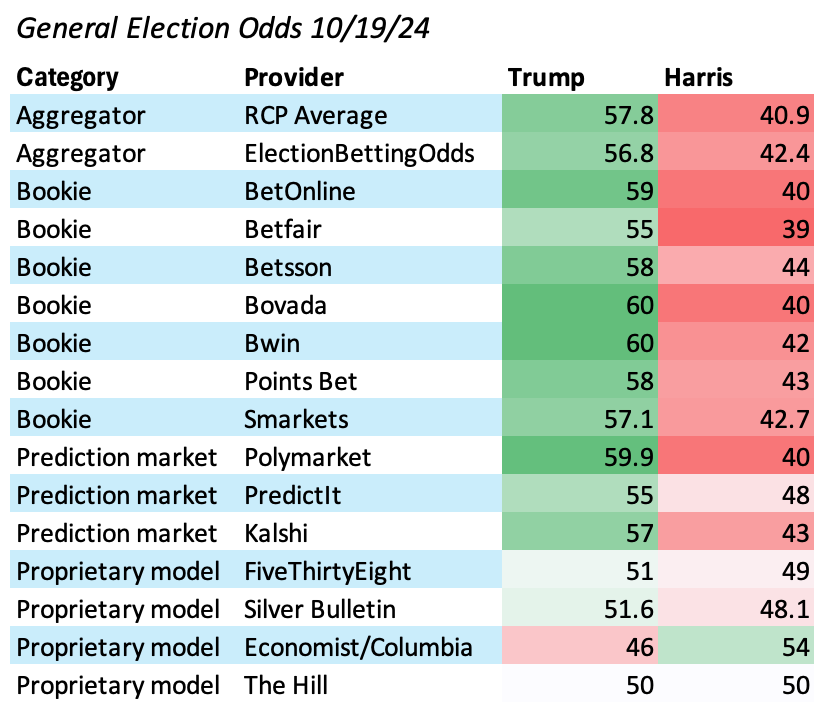

of Imperfect Information published a piece today with an update on the widening gap between the election odds displayed by statistical models versus those of the prediction markets. And while both the election models and the prediction markets are trending in the direction of a Trump victory, the divergence between the two persists.Indeed, though the major statistical models have continued trending in Trump’s favor,1 most are still effectively conveying a toss-up.

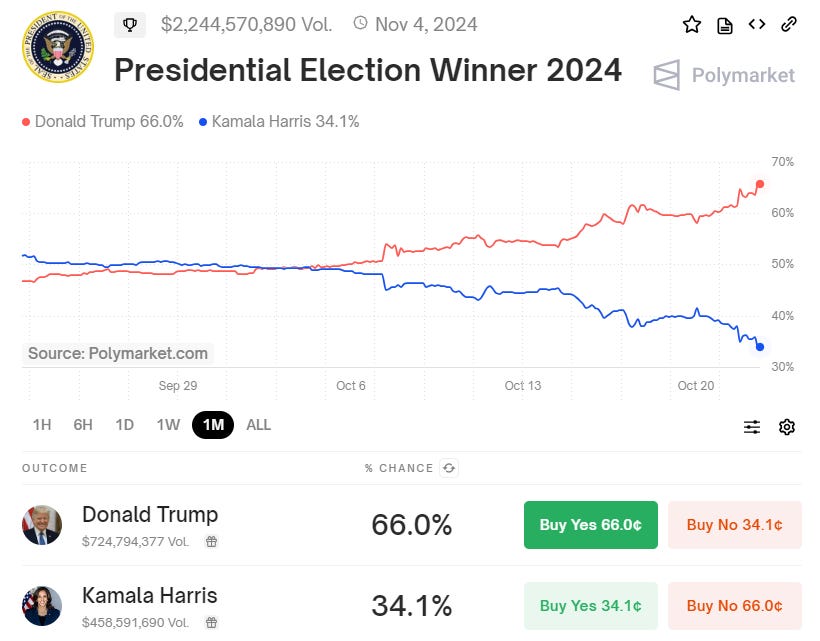

But meanwhile, prediction market odds have increasingly diverged, with Polymarket showing as high as a 66% probability (or two-thirds) for a Trump victory.

Aside from Polymarket, the other major prediction market odds are also showing a substantial divergence from the most reliable election models—PredictIt and Kalshi (U.S. bettors only) both now have Trump’s odds of victory at 60%+.

The persistence of the roughly 10-point divergence from statistical models has many asking questions: Are the prediction markets being manipulated by large buyers of pro-Trump contracts? Are they simply a leading indicators whereas the election models are coincidental indicators (reliant on more static polling data)? Is Trump really pulling that far ahead?

Polymarket has spoken

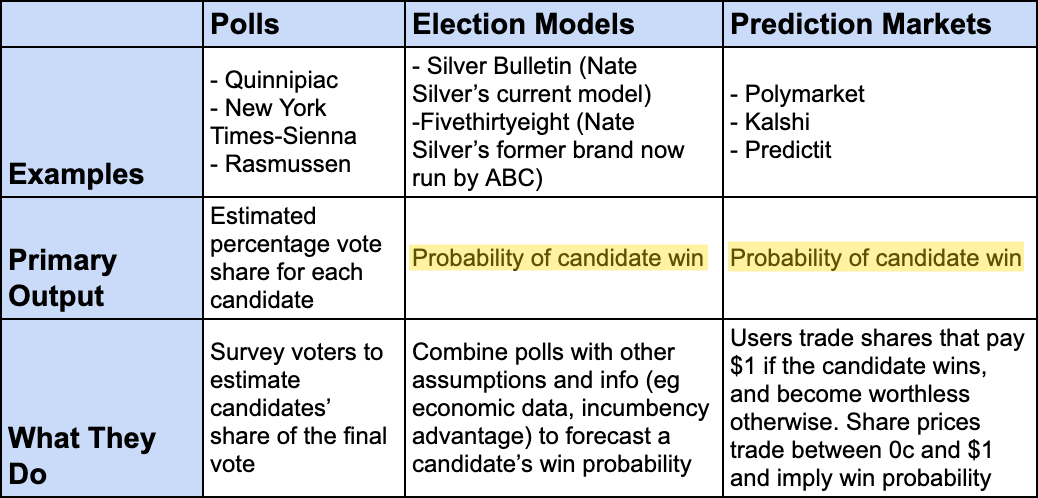

, which has launched a Substack publication of its own, posted an article yesterday (10/21) titled 🔮Polymarket Voodoo whereby it sought to dispel a few key notions. While they were quick to revel in the recent notoriety the platform has been garnering (can you blame them?), I did find several points they made noteworthy. Chief among those points is that it’s important to distinguish between polls, election models, and prediction markets. The article broke down these distinctions with a table:

Importantly, note that ‘probability of candidate winning’ is the primary output of both election models and prediction markets. So, in theory, comparing (let’s say) the Silver Bulletin election model to Polymarket odds is indeed an apples-to-apples comparison, so to speak. Emphasis on “in theory,” because per Polymarket, “Prediction markets react to news with a few clicks of a mouse, whereas election polling can take days to weeks to update.” This is to say that, in reality (as opposed to theory), election models lag prediction markets.

The article also addressed the claim that Polymarket odds skew conservative, a phenomenon being referred to by some as “Polymarket voodoo.” That is, “a systematic bias on the platform towards Republicans.”

Polymarket pushes back on this notion by referring to a table comparing several forecast methods, noting that each of the major prediction market maker odds (not just Polymarket) have diverged from the major election models.

Finally, the article addressed increasing talk of so-called “whales” distorting the prediction markets:

“First, because Polymarket is built on top of public software networks, anyone on the internet can see what is happening on Polymarket at any time, including what accounts hold what shares. This information is free and public – a high degree of transparency generally and significantly higher than other trading platforms.

Second, it is common in financial markets for there to be a power law, or 80-20 principle, i.e., a few whales and many minnows … Clicking “Top Holders” on most other markets reveals a similar whales and minnows dynamic.”

So Polymarket’s rationale for this divergence is that:

Election models lag prediction markets given the frequency of underlying inputs (i.e., prediction market pricing based on buying/selling in real-time versus more static polling data being used to update election models)

All of the prediction market odds have diverged from election model odds, not just Polymarket odds

Furthermore, Polymarket argues that its markets aren’t being distorted by whale traders given that 1) Prediction markets are transparent about which accounts hold which positions, and 2) Like any financial market, prediction markets have a ‘few whales and many minnows’ dynamic. True, and fair enough, right? Not quite, and I’ll explain why later.

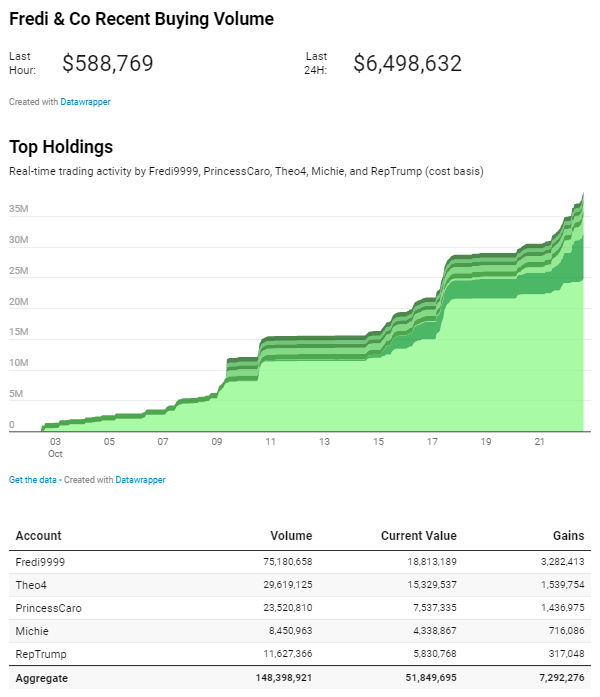

The latest on Fredi & Co

In my previous piece on this topic, I mentioned the “whale” catching everyone’s attention: Fredi9999. I’ve recently come across (and interacted with) a person here on Substack named

. He and his associates at The Super Model have built out a model for tracking this whale in real-time. And as we’ve come to find out, Fredi9999 is actually just one of at least five Polymarket accounts associated with the same individual (or entity). “Fredi & Co” is what they’re calling this whale entity.2Since my last post on this topic (10/17), Fredi & Co has only accelerated its purchasing of pro-Trump positions (pro-Republican positions, not just Trump).

Furthermore,

proposed that Fredi & Co could be operating from at least one of five different angles (the last of which I completely failed to consider in my previous post):Profit seeker (outsider)

Profit seeker (insider)

Natural hedger

Electoral manipulator

Manipulator of DJT stock price

And it stands to reason why a bullish investor in Trump Media (which operates the Truth Social app) would have an incentive to bid up the odds of a Trump victory in the prediction markets. Indeed, shares of Trump Media stock DJT 0.00%↑ have basically tripled off the lows from less than a month ago (in tandem with the precipitous rise in pro-Trump betting odds).

Now, given the lack of conclusive information surrounding this whole situation, it would be foolish to assume that Fredi & Co are operating from a nefarious angle. Nonetheless, it can’t be ruled out.

But the question remains: are the prediction markets in fact the ‘best guess’ with respect to the outcome of the election?

Prediction market odds should still be viewed skeptically

Recall Polymarket’s rationale for the phenomenon occurring in the betting markets. Specifically, that prediction markets are a leading indicator versus election models, which are more coincidental (and thus, the current divergence between the two). I have nothing to argue on this point—financial markets, broadly speaking, are efficient forecasting mechanisms given all relevant information (past, present, and future). It’s for this reason that when a company releases quarterly earnings, the stock price trades more-so based on management’s forward guidance than it does on quarterly results, which are backward-looking.

I do, however, take exception to Polymarket’s argument that their platform’s odds aren’t distorted simply because all of the other prediction market odds are similarly diverged from the election models’ odds. In my view, this argument is misguided for several reasons.

Polymarket is the largest event-driven prediction market, and was the first of the prediction markets to have odds diverging from the odds conveyed by the statistical models.3 It wasn’t until several days later (10/10) that odds on other prediction market platforms, such as Kalshi and PredictIt, became more closely aligned (more diverged from election model odds) with the Polymarket odds. I argue that following the initial divergence, this alignment occurred as a result of arbitrageurs capitalizing on the discrepancy4, as opposed to pure price discovery. In other words, Polymarket odds set the price and other markets fell in line in due time.5

Furthermore, in financial markets, prices are influenced by both information and expectations. For this reason, I can envision a scenario in which the prediction market odds are influencing the election model odds. A circular feedback loop, of sorts—as election models adjust to reflect the odds observed in prediction markets, this further validates the market prices. Market participants, seeing that models are beginning to move in line with market odds, may feel more confident that the market has priced in future developments more accurately than the models alone. This perception strengthens the prediction market odds, which again reinforces the models’ adjustments.

In essence, the initial divergence in prediction market odds sets off a chain of reactions where market prices influence the election models, and in turn, the models’ adjustments reinforce the original market prices, leading to a potential cycle of feedback between the two systems.

Of course, this is all just based on my inclinations knowing what I do know about financial markets. I’ve seen more than a few market overreactions in my lifetime, and 66% ‘Trump yes’ odds strikes me as one—though not as extreme as the stock market’s Covid crash in 2020 or crude oil futures turning negative.

Per Rajiv’s post, “The statistical models that I have been tracking all see the race as a toss-up—the likelihood of a Trump victory is currently 51 percent at FiveThirtyEight, 53 percent at Silver Bulletin, and 54 percent at the Economist. All three models have been close for a while now, although there were moments of considerable divergence since the Democratic nomination was officially secured by Harris in early August.”

Fredi & Co is the combined activity of the five accounts presumed to be under common control: Fredi9999, PrincessCaro, Theo4, Michie, and RepTrump

That is, traders who seek to exploit profit opportunities when some asset (stock, commodity, election outcome contract, etc.) is trading at two different prices in two different marketplaces.

My rebuttal of Polymarket’s rationale rests on two key assumptions (assumptions that I’m willing to make). First, I assume that there’s enough awareness of election prediction markets such that astute bettors would come in and wage money against a ‘Trump yes’ contract in the event that such bettors see the ‘Trump yes’ contracts as overpriced. Second, I assume that Fredi & Co is more liquid, and generally more able and willing to make the incremental pro-Trump wager than are the contra-Trump bettors who are coming in and betting on Kamala on an expected value basis.

*Nonetheless, if I were a betting man, I’d say there’s value to be had in betting ‘Kamala yes’ right now given the prediction markets’ divergence from election models’ odds.*

For individuals in the US at least the tax code eliminates most or all of the value from the divergence. Winnings are taxed at ordinary rates, while losses are not deductible. For a top-bracket CA resident, buying a 50-50 bet for 40 cents is barely breakeven.

Professionals can deduct gambling losses. But I suspect most professionals are looking to make lots of small bets, each with a little edge; not a single big bet on a coin-toss once every four years.

how do you explain that the betting markets and polls way underestimated trump in both 2016 and 2020 and what was done to correct for this bias? Perhaps if you suggest a gold standard method rather than cautionary notes about every method currently out there, we can assess confidence in betting market odds vs. polls vs. Nate silver, etc.